Business Loan Basics: Everything You Need to Get Started

Business loans are an integral part of almost any company’s dealings, whether it be a small mom-and-pop operation or a corporate monolith with offices all over the world. The two types of loans a business can receive are either secured or unsecured. There are benefits and pitfalls to both.

Your business loan options

A secured loan means that the business receiving the monies puts up some form of distinct collateral, which can be either physical property or some more liquid entity that the loan institution can collect if the business fails to meet the terms of the loan. An unsecured loan involves no such collateral, meaning that a failure to repay the loan can lead only to damaged credit, decreased confidence, and in many cases, total bankruptcy. Secured loans are clearly the safer bet, in a sense—though they actually involve risking more than unsecured loans at which no tangible good is at risk in the course of the loan.

A secured loan means that the business receiving the monies puts up some form of distinct collateral, which can be either physical property or some more liquid entity that the loan institution can collect if the business fails to meet the terms of the loan. An unsecured loan involves no such collateral, meaning that a failure to repay the loan can lead only to damaged credit, decreased confidence, and in many cases, total bankruptcy. Secured loans are clearly the safer bet, in a sense—though they actually involve risking more than unsecured loans at which no tangible good is at risk in the course of the loan.

In order to get a secured business loan, a business must have already achieved enough that it can afford to put up sufficient collateral. Many businesses looking for loans, particularly startup loans, are not yet in a position of being able to guarantee repayment through collateral, but as they need the money to grow their business, they must still get a loan of some kind. It is in this context in which the bulk of unsecured business loans are granted.

But the path of taking an unsecured business loan is one filled with peril. Most small businesses fail in their very first year, often owning as much to taking on debts the small business is unable to pay as to the inability to generate sufficient revenue to continue operations. Small businesses must be particularly wary about taking on unsecured debt as so much of it is still offered, despite these troubled times, upon the formation of a business.

Major incentives are given to lenders to support small businesses and this can lead to a proliferation of debt without the necessary checks and balances in place to ensure that the bulk of those debts get paid. When one company with unsecured debt gets into serious financial hot water, this can put the company’s creditor in some level of jeopardy, as well, and this can ultimately escalate to the sort of credit crisis the nation was facing just a short time ago. The safest way for a business to receive a loan is in a secured agreement, but sometimes an unsecured loan is the best one a business can find.

Consider a business loan broker

When in the market for a business loan, consider working with a business loan broker. A broker of any kind is a facilitator or advocate who works out of a brokerage house and helps to arrange deals between two interested parties, generally acting primarily on the behalf of the party that initially hired the broker. Brokers can facilitate deals involving real estate, company mergers, corporate takeovers, and, as is relevant here, business loans. The broker, once hired by a business in search of additional funds through a loan, will then proceed to reach out to lending institutions as well as alternative sources of unsecured funds in an effort to provide the client with a suitable loan to meet the client’s needs.

Business loan brokers do not always require any formal training, though many possess college as well as advanced degrees, and are often licensed through a number of national, state and local agencies. With more and more companies needing to operate to a certain extent on credit due to the current state of economic uncertainty, the business of business loan brokers is booming. Business loan brokers not only find sound lending sources for loaning money to businesses that need it, they also help “massage” the lender, aiding in the effort to convince the lender that it makes sense to loan money to the business which is the client of the broker. This can be done through all sorts of persuasion techniques, from financial reports to future earnings projections to good, old-fashioned face to face salesmanship.

Business loan brokers do not always require any formal training, though many possess college as well as advanced degrees, and are often licensed through a number of national, state and local agencies. With more and more companies needing to operate to a certain extent on credit due to the current state of economic uncertainty, the business of business loan brokers is booming. Business loan brokers not only find sound lending sources for loaning money to businesses that need it, they also help “massage” the lender, aiding in the effort to convince the lender that it makes sense to loan money to the business which is the client of the broker. This can be done through all sorts of persuasion techniques, from financial reports to future earnings projections to good, old-fashioned face to face salesmanship.

The best business loan brokers have a veritable sea of contacts in the financial services and lending industries and can conjure up business loans with just the right flip of the Rolodex. A business looking to hire a broker should always perform due diligence on that broker’s track record and career history, since the business of procuring loans is fraught with temptation, and more than a few business loan brokers have added “additional fees” to their services by skimming some off the top of a loan that was intended for a client. However, regulation of the lending industry is becoming ever more meticulous and litigious, so such unethical practices now take place with a far lower degree of regularity than they might have in the past.

A good business loan broker can prove invaluable when he or she helps a business that’s either just starting out or that is struggling with any manner of economic reversal to secure the funds necessary to grow the business or to get the business back on the right track.

More inFinancial Adviser

-

Glow Green: Marie Claire’s Eco-Friendly Beauty Brands

As we paint our faces and pamper our skin, there is been a whisper among the beauty grapevines: Can we shine...

November 24, 2023 -

George Clooney ‘To Sell Iconic Lake Como Villa’

Nestled in the serene beauty of Lake Como, George Clooney’s stunning 18th-century villa, Villa Oleandra, is making headlines once again. The...

November 14, 2023 -

4 Impactful Sustainable Business Practices

In the ever-evolving landscape of modern businesses, sustainability has emerged as a game-changer. Gone are the days when organizations viewed sustainability...

November 9, 2023 -

Bollywood A-Listers Who Are Also Active Tech Startup Investors

Bollywood and technology may seem like an odd couple, but in recent years, these two worlds have collided in the form...

November 1, 2023 -

Why Fashion Lovers Are Embracing Sustainability

In a world where a freshly brewed cup of coffee seems more luxurious than before, and your favorite brand’s spring collection...

October 24, 2023 -

Inside Kim Jong Un’s Infamous Armored Train

The mysterious world of North Korea has long fascinated the international community. Recently, images emerged in Russian and North Korean state...

October 22, 2023 -

Employees Are Becoming Millionaires Before Retirement | How You Can Join the Millionaire Club Too!

Have you ever daydreamed about being part of the millionaire’s club? Maybe, in those dreams, you are sipping a cocktail on...

October 12, 2023 -

The Osbournes’ Big Return: From TV Madness to Podcast Fun

Hold on to your earphones, rock fans, and reality TV junkies! The infamously lovable Osbourne clan is back, and this time...

October 8, 2023 -

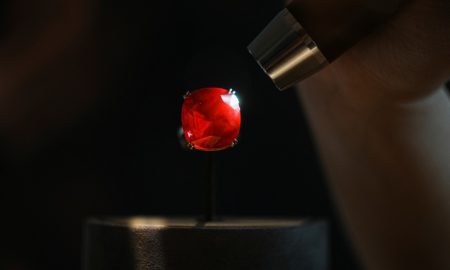

Estrela de Fura: Largest Ruby Auctioned for $34.8 Million

In a stunning turn of events, a historic auction at Sotheby’s in New York has shattered records as the largest ruby...

September 30, 2023

You must be logged in to post a comment Login