These Bigwigs Took a Loan and Turned it into a Million-dollar Business

Millionaires certainly enjoy the good life and can afford fancy mansions and cars but most didn’t start out rich. Like many with an idea that could be profitable, these moguls took loans out to chase their dreams and turn it into reality. And it worked! Here are five best loan-to-success stories:

Barbara Corcoran (Net Worth $80 Mn)

Barbara Corcoran developed the Corcoran Group, a huge real estate company which eventually sold in 2001 for $66 million. But she started with a $1,000 loan taken from her boyfriend way back the 1970s. The Shark Tank judge used the funds to pay the rent for her first apartment and for her venture’s marketing purposes, quickly building on that success mostly due to creativity, and with a whole lot of luck. With cleverly worded property advertisements when they were starting out, she created her business online, something that her competitors had not done as yet.

Jessica Iclisoy (Net Worth $260 Mn)

Jessica Iclisoy is not a very famous name, but what she has created is a hit with millions of moms in this country. Jassica was dissatisfied with available shampoos for her tiny baby and created one using ingredients that are natural. Iclisoy founded a company called California Baby in 1995 and found herself needing funds to create her first product, so she borrowed a sum of $2,000 from her own mom. She pitched the shampoo to Whole Foods, managing to get herself a shelf spot. Just 6 years later, her products were being sold at Target and they are now available in more than 10,000 stores.

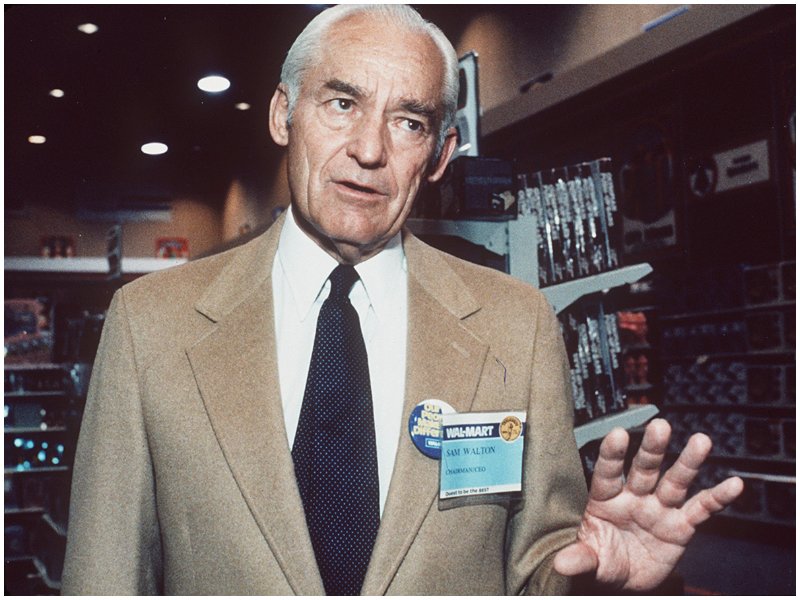

Sam Walton (Net Worth $100 Bn)

It’s impossible for an American to remain unconnected with Sam Walton’s business as he founded and established the Walmart chain, which, as you know, is a billion-dollar company. Walton first opened his flagship general store in the year 1945 with just a $20,000 loan taken from his father-in-law. Soon enough, Walton started a mini-empire, opening his first Walmart-branded store, way back in 1962, which placed him on the road to success. Although he passed away in 1992, Walmart continues to be the most prosperous discount stores ever, with Walton leaving $100 billion for his family. And to think of it, everything began with a loan.

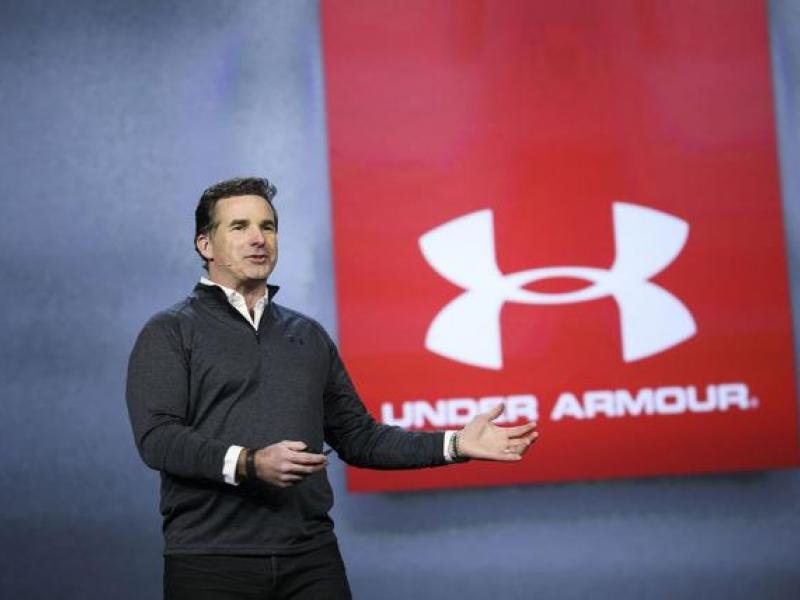

Kevin Plank (Net Worth $2.1 Bn)

Under Armour retails athletic gear to support you through a back-breaking workout. When it’s CEO, Kevin Plank, was facing a cash-crunch going through the company’s startup phase, he made good use of his credit cards and balanced those loan sources to get the company through difficult times. Though Plank had his savings, he still had to charge $40,000 on his credit cards to make his fitness apparel company a reality, which became very successful. Kevin later approached a bank to scale up his venture. The company is today valued at over $9.3 billion. Seems like the credit card loan was worth it, after all.

Sir Philip Green (Net Worth $4.8 Bn)

More inFinancial Adviser

-

5 Billionaire Playboys Who Dated Beautiful Hollywood Celebrities

5. Salma Hayek and François-Henri Pinault: A Fairytale of Fashion and Film Salma Hayek, the Mexican-American actress whose performances have captivated...

November 29, 2023 -

Glow Green: Marie Claire’s Eco-Friendly Beauty Brands

As we paint our faces and pamper our skin, there is been a whisper among the beauty grapevines: Can we shine...

November 24, 2023 -

George Clooney ‘To Sell Iconic Lake Como Villa’

Nestled in the serene beauty of Lake Como, George Clooney’s stunning 18th-century villa, Villa Oleandra, is making headlines once again. The...

November 14, 2023 -

4 Impactful Sustainable Business Practices

In the ever-evolving landscape of modern businesses, sustainability has emerged as a game-changer. Gone are the days when organizations viewed sustainability...

November 9, 2023 -

Bollywood A-Listers Who Are Also Active Tech Startup Investors

Bollywood and technology may seem like an odd couple, but in recent years, these two worlds have collided in the form...

November 1, 2023 -

Why Fashion Lovers Are Embracing Sustainability

In a world where a freshly brewed cup of coffee seems more luxurious than before, and your favorite brand’s spring collection...

October 24, 2023 -

Inside Kim Jong Un’s Infamous Armored Train

The mysterious world of North Korea has long fascinated the international community. Recently, images emerged in Russian and North Korean state...

October 22, 2023 -

Employees Are Becoming Millionaires Before Retirement | How You Can Join the Millionaire Club Too!

Have you ever daydreamed about being part of the millionaire’s club? Maybe, in those dreams, you are sipping a cocktail on...

October 12, 2023 -

The Osbournes’ Big Return: From TV Madness to Podcast Fun

Hold on to your earphones, rock fans, and reality TV junkies! The infamously lovable Osbourne clan is back, and this time...

October 8, 2023

You must be logged in to post a comment Login