Financial Rules Which You Need to Memorize

There are tomes written on how to conduct your personal finance so that you save for the future, maintain a reasonable life-style, buy a house and educate your children and also save for your retired life. There are plenty of personal finance strategies, tips, and rules, which could impact your financial health. But, some rules are more significant than the others. The Golden Rule is to resort to tax-planning but not Tax-avoidance or Tax-fraud. Besides, these are four specific personal financial rules that can determine your current and possibly future financial health:

1) Avoid all Credit Card Debt

Most people understand that any credit card debt is “bad debt,” but resort to it unfailingly. Almost 46% of U.S. families have credit card debt, with average outstanding balance at $15,654. A general finance rule is avoiding any and all credit card debts, without fail. It is always better to finance a purchase with personal loans, a 401(k) loan or home equity loans, rather than pay huge interest rates on your credit card.

The possible exemption is if your credit card debt interest is at no cost/ low cost and you can repay in full, long before the substantial interest rate kicks in. For instance, when buying your house, furniture can be bought with a 60-month delayed interest offer on the store’s credit card, taking care to repay the balance prior to the expiry of the promotional period. Beware of deferred interest financing offer pitfalls. If you are unable to repay the entire outstanding balance when the 60 months are up, the interest bill accumulates over the entire period on the card’s standard 29.99% interest rate.

2) Save/Invest a Minimum 10% of Earnings for Retirement

A common query is “How much do I put in my 401(k) account?” The inevitable answer is that 10% of your salary is a credible and achievable target. This standard rate is applicable for all retirement accounts in a 403(b), IRA, Thrift Savings Plan, 457 or any other long-term retirement account. However this excludes the employer matching contributions, and investments made in standard brokerage (taxable) accounts.

The thumb-rule is to set aside 10% pre-tax earnings for all your retirement savings and appears to be very difficult to achieve, especially if you are saving only 5% now. But you do not need to double this immediately. Slow and steady increases of your input rate by 1% every year, would be great, till you achieve 10%. Remember to enhance your contribution rate every time you secure a raise. The caveat is that any number above 10% is always better. It is always smart to be well prepared for retirement.

3) Create an Emergency Fund

It is indeed very tough to plan for personal redundancy but it is necessary to plan for your retirement, with a credible retirement fund. Bankrate.com reported finding that 61% of American citizens would be incapable of paying $1,000 in emergency expenses from their nest egg and would have to borrow.

Experts are of the opinion that an emergency fund should meet six months’ living expenses in an easily accessible account, and this is a huge lot of money. Do not despair as a majority of Americans without a large savings account, set more realistic goals, starting with $500 or $1,000, which can be reasonably achieved in a year. To achieve this, divide the goal amount by the sum total of times you are paid each year, and arrange an automatic transfer from your bank account. When you achieve $1,000, you are better equipped to deal with emergencies than most people.

4) Always Evaluate your Means and Live Below it

Most people consider that if they stop spending more than what they earn, they will continue to be in great financial shape. Do go a step higher and make efforts to always spend lesser than you earn, after setting aside a sum for savings, investments, taxes and emergencies.

You need not buy a very expensive car for your use even if you have enough money it. A lesser-priced model may meet your taste and your needs adequately. If your take home salary is $5,000 per month and you save $1,000 for retirement and unforeseen expenses, you must ensure that you spend considerably less than $4,000 every month.

Perspectives

Of course, these are only personal money rules you ought to begin with, but they are the most vital ones. If you avoid any credit card debt, save approximately 10% of your paycheck for retirement planning, build up a considerable emergency fund, and continue to live below your means, you would find yourself financially independent for life.

More inFinancial Adviser

-

Glow Green: Marie Claire’s Eco-Friendly Beauty Brands

As we paint our faces and pamper our skin, there is been a whisper among the beauty grapevines: Can we shine...

November 24, 2023 -

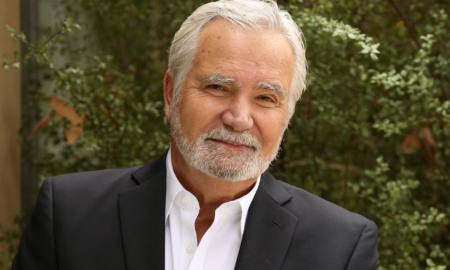

George Clooney ‘To Sell Iconic Lake Como Villa’

Nestled in the serene beauty of Lake Como, George Clooney’s stunning 18th-century villa, Villa Oleandra, is making headlines once again. The...

November 14, 2023 -

4 Impactful Sustainable Business Practices

In the ever-evolving landscape of modern businesses, sustainability has emerged as a game-changer. Gone are the days when organizations viewed sustainability...

November 9, 2023 -

Bollywood A-Listers Who Are Also Active Tech Startup Investors

Bollywood and technology may seem like an odd couple, but in recent years, these two worlds have collided in the form...

November 1, 2023 -

Why Fashion Lovers Are Embracing Sustainability

In a world where a freshly brewed cup of coffee seems more luxurious than before, and your favorite brand’s spring collection...

October 24, 2023 -

Inside Kim Jong Un’s Infamous Armored Train

The mysterious world of North Korea has long fascinated the international community. Recently, images emerged in Russian and North Korean state...

October 22, 2023 -

Employees Are Becoming Millionaires Before Retirement | How You Can Join the Millionaire Club Too!

Have you ever daydreamed about being part of the millionaire’s club? Maybe, in those dreams, you are sipping a cocktail on...

October 12, 2023 -

The Osbournes’ Big Return: From TV Madness to Podcast Fun

Hold on to your earphones, rock fans, and reality TV junkies! The infamously lovable Osbourne clan is back, and this time...

October 8, 2023 -

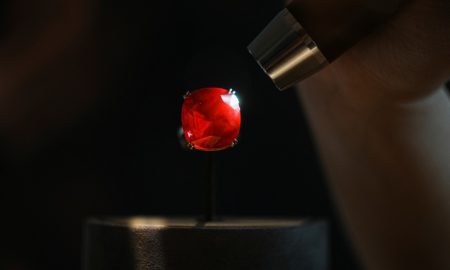

Estrela de Fura: Largest Ruby Auctioned for $34.8 Million

In a stunning turn of events, a historic auction at Sotheby’s in New York has shattered records as the largest ruby...

September 30, 2023

You must be logged in to post a comment Login