Insider Scoop: What It’s Really Like to Work with Celebrity Clients

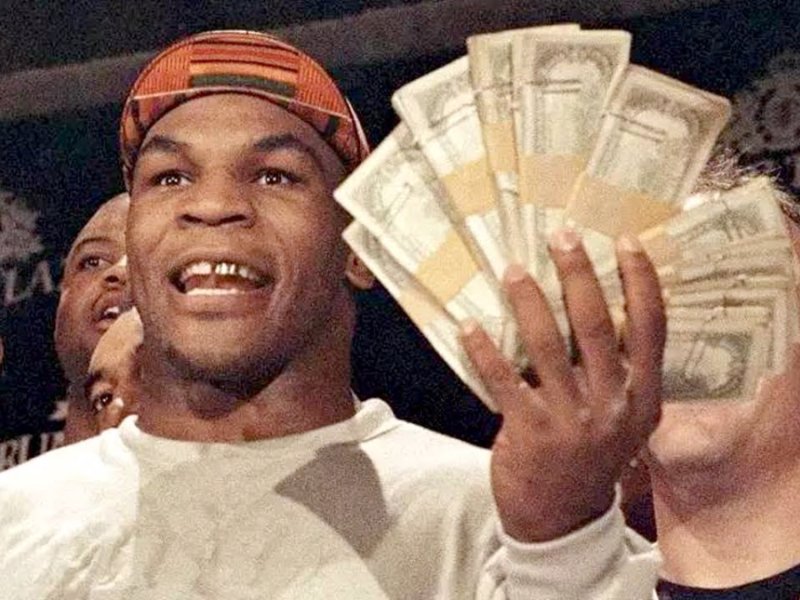

Many decades of assisting celebrities and professional athletes has enabled Jordan Waxman to carve out a successful sports and entertainment group niche inside HSW, a $2.5 billion, New York-based financial planning firm. While he recognizing major differences between athletes and entertainers, Waxman is not awestruck by his clients, whom he never identifies by name.

Such clients need more planning as they are less financially savvy. They delegate quite a bit, because they generally have people running things for them. Beyond some common quirks and dodging autograph seekers, a practice built around athletes and entertainers must specialize in tax management and legal protections, besides traditional asset management.

Unique Planning Needs

A Restricted Market

A Differentiated Clientele

More inRich & Famous

-

Why Is the Price of Beef Rising in 2024?

Grocery shopping has become a challenging task with prices consistently on the rise. You may recall the unexpected surge in egg...

June 18, 2024 -

Did Tyler Perry Buy BET? The Story Behind the Partnership

Did Tyler Perry buy BET? While the media mogul’s attempt to acquire BET captured headlines in 2023, the story took an...

June 10, 2024 -

Fun and Exciting Things to Do When You’re Bored With Friends

Ever feel that awkward silence creeping in during a hangout with your friends? Been there, done that! We all know the...

June 4, 2024 -

What Is Equity in Business? Here’s What You Need to know

When embarking on the journey of growing a business, it’s crucial to grasp the concept of equity. So, what is equity...

June 2, 2024 -

Here Are the Best Saving Money Challenge to Boost Your Bank Balance

Ever feel like saving money is a daunting task? Imagine turning it into a fun game or a friendly competition! This...

May 25, 2024 -

Is Cardi B Dominican? The Star Sets the Record Straight on Her Identity

In the vibrant world of social media, where every aspect of a celebrity’s life is scrutinized, Cardi B recently took a...

May 19, 2024 -

Why Is It Important to Reconcile Your Bank Statements? The Ultimate Guide

Why is it important to reconcile your bank statements? Many business owners view bank statement reconciliation as a tedious task. However,...

May 12, 2024 -

Unlock Free Trips By Paying Mortgage & Loans with Credit Cards

Making large payments wouldn’t have been easier if it weren’t for credit cards. The system ensures full safety and quick transfer....

May 2, 2024 -

Skimpflation: Is Luxury Losing Its Luster?

In the glamorous world of luxury, a quiet revolution is underway, and it goes by the name of ‘skimpflation.’ Imagine your...

April 26, 2024

You must be logged in to post a comment Login