The USA Is on the Verge Of Being Named The United States Of Indebted America

According to a fresh national map of indebtedness published by the Urban Institute earlier this week nearly 50% of the residents of Louisiana are facing problems with debts which have gone into collections. Louisiana is now considered the capital of America for debts which are past the due date.

The numbers published were derived by the Urban Institute from studies of anonymized consumer level records that were shared with the researchers from Urban by a prominent credit bureau. The numbers contain figures of unpaid bills that have been closed by creditors or are making attempts to recover and displayed as “in collections.” Unpaid credit card bills are usually sent to collections after 180 days as mentioned by the Urban Institute.

Indebtedness Is Prominent In America

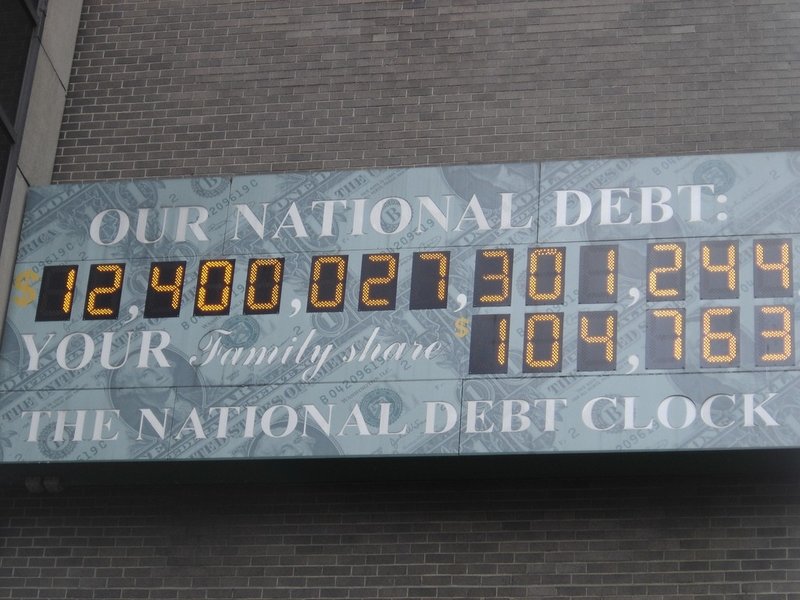

According to nationwide data which has been collected, it has been revealed that nearly 33% of Americans are holding debt which is present in the collection. The minimum amount of debt in collection is $1450.

However, the figures mentioned are showing a regional variation which is striking. Adults in Louisiana, 46% of them have debt in the collection which is considered the highest share in the country. The rates of past due outstanding figures are generally the highest in the southern and the Western states but are lowest in the upper Midwest. Minnesota, for example, has just 17% adults that have debt in collections which are believed to be the least in the country.

At the county level, the residents of Allendale County, SC, which has a population of 9433 has 68% of the people that are holding debt which is presently in collections. In sharp contrast is Cook County Minnesota which has the lowest rate of overdue debt in the country which stands at 6%.

Research conducted earlier by the Urban Institute had identified the coverage of health insurance as the prime reason for indebtedness. This is a clear indicator that people with health insurance coverage are in most cases unlikely to lag behind on making payments.

The Researchers Of Urban Institute Considered Data From across the Nation

The researchers of Urban observed that nearly one out of five households are combating with a problem of medical debt being in collections and the minimum amount is $681. However, this particular number also differs widely from overdue medical debt in Louisiana being 10 times higher [approximately 30%] than in Minnesota [approximately 3%].

When the researchers decided to look at the relationship between outstanding debt and overdue medical debt they observed that a single percentage point increase among the share of population without health coverage contributed to a 0.16 percentage point increase in the chances of having debt in collections along with a 1.3% increase in the average amount that was overdue in collections.

The Texas and Louisiana counties, among others, have more than 60% population which carries overdue medical debt in collections. The available figures indicate a connection between physical and financial health. Americans are spending more money on health care than other developed nations and it is astonishing to note that Americans also succumb at a younger age than people in other developed countries. The data published by the Urban Institute clearly indicates that Americans are saddled with skyrocketing costs of healthcare and therefore nearly 20% of the population is holding debt which they are unable to pay.

The figures provided by the Urban Institute were disclosed on December 8, 2017, after which the president of America has issued executive orders which are likely to enhance the costs of health insurance. Estimates are presently available that insurance companies may increase premiums by approximately 20% to leave Americans with additional debt burdens. The outlook for people who are already holding on to overdue bills is definitely not favorable.

If the relationship between physical and financial health is considered it is a certainty that an increase in insurance premiums will only aggravate the conditions. The numbers of people without health insurance is likely to increase in the present conditions. Under the circumstances, their financial health is going to take a toll on their physical health. People will not be in a position to afford expensive medical care or gain admissions into emergency rooms because their financial health will not permit them to. The numbers of people with debt in collections will increase dramatically leading everyone to believe that this country should henceforth be addressed as the United States of indebted America.

More inFinancial Adviser

-

Why Is the Price of Beef Rising in 2024?

Grocery shopping has become a challenging task with prices consistently on the rise. You may recall the unexpected surge in egg...

June 18, 2024 -

Did Tyler Perry Buy BET? The Story Behind the Partnership

Did Tyler Perry buy BET? While the media mogul’s attempt to acquire BET captured headlines in 2023, the story took an...

June 10, 2024 -

Fun and Exciting Things to Do When You’re Bored With Friends

Ever feel that awkward silence creeping in during a hangout with your friends? Been there, done that! We all know the...

June 4, 2024 -

What Is Equity in Business? Here’s What You Need to know

When embarking on the journey of growing a business, it’s crucial to grasp the concept of equity. So, what is equity...

June 2, 2024 -

Here Are the Best Saving Money Challenge to Boost Your Bank Balance

Ever feel like saving money is a daunting task? Imagine turning it into a fun game or a friendly competition! This...

May 25, 2024 -

Is Cardi B Dominican? The Star Sets the Record Straight on Her Identity

In the vibrant world of social media, where every aspect of a celebrity’s life is scrutinized, Cardi B recently took a...

May 19, 2024 -

Why Is It Important to Reconcile Your Bank Statements? The Ultimate Guide

Why is it important to reconcile your bank statements? Many business owners view bank statement reconciliation as a tedious task. However,...

May 12, 2024 -

Unlock Free Trips By Paying Mortgage & Loans with Credit Cards

Making large payments wouldn’t have been easier if it weren’t for credit cards. The system ensures full safety and quick transfer....

May 2, 2024 -

Skimpflation: Is Luxury Losing Its Luster?

In the glamorous world of luxury, a quiet revolution is underway, and it goes by the name of ‘skimpflation.’ Imagine your...

April 26, 2024

You must be logged in to post a comment Login