Lessons from Warren Buffett, the Third Richest Person in the World

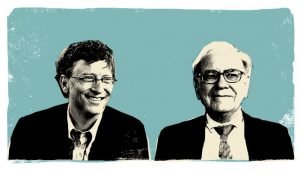

No listing of the world’s wealthiest is ever complete without the presence of billionaire investor Warren Buffett. The man who is fondly known as the “Oracle of Omaha” has been in the third spot of the list of the richest people on the planet for a very long time, just behind Jeff Bezos of Amazon at number 2 and Microsoft’s Bill Gates at number 1, who, incidentally, is one of Buffett’s good friends.

Recently, Buffett made news yet again when his net worth saw an increase of over $8 billion in the last 12 months. As of this writing, his current net worth is at a whopping $81.6 billion. Astonishingly, the world’s third-richest person just seems to only keep getting richer. Today, Buffett has stakes in companies like IBM and Wells Fargo, yet the majority of his wealth still comes from his own company in which he has an 18% stake.

Recently, Buffett made news yet again when his net worth saw an increase of over $8 billion in the last 12 months. As of this writing, his current net worth is at a whopping $81.6 billion. Astonishingly, the world’s third-richest person just seems to only keep getting richer. Today, Buffett has stakes in companies like IBM and Wells Fargo, yet the majority of his wealth still comes from his own company in which he has an 18% stake.

Indeed, reaching that level of wealth may seem impossible, but Buffett is proof that it can be done. Indeed, there is much to learn from the great man himself. Thankfully, he’s quite happy to share the following tips.

Start early.

The billionaire’s impressive story of success starts very early in the great man’s life and is a very inspiring one. Born in Nebraska, the young Buffett spent a lot of time in the customer’s lounge of a stock brokerage firm near his father’s office. On a family trip to New York City at age 10, he made sure to visit the New York Stock Exchange. The following year, at age 11, he made his first stock purchase, buying Cities Service Preferred shares for himself and his sister, Doris.

His first big venture was in 1962 when he bought the textile manufacturer Berkshire Hathaway. As CEO, he then expanded it into a holding company. It has since acquired major corporations such as Kraft Heinz and Geico.

Think long-term.

In 1972, Buffett and business partner Charlie Munger purchased See’s candies. He also bought $1 billion worth of Coca-Cola stock in 1988. This was because he saw that both businesses were worth investing in.

That’s how he decides on whether or not he will invest in a business—because he is sure that it will last. “We sort of know it when we see it,” he said.

Not only that, he makes sure that he really likes a business before going into it because once he makes the investment, he really holds onto it.

Playing the market is a real no-no.

Contrary to popular belief, even a big-time and expert investor like Buffett can’t predict the stock market’s ups and downs. This is the reason why he doesn’t recommend playing the market as it is much too risky.

For those who want to grow their retirement investments, Buffett recommends going for index funds. In a nutshell, index funds such as the S&P 500 keep every stock in an index, including those from successful companies like Apple, Google, and Microsoft. Index funds are relatively stable, as opposed to individual stocks. They’re also affordable enough for the average investor.

Stick with it.

The stock market will always have periodic highs and lows. This movement will affect all kinds of stocks, including the relatively low-risk index funds. The important thing is not to get discouraged when the inevitable dips occur.

The stock market will always have periodic highs and lows. This movement will affect all kinds of stocks, including the relatively low-risk index funds. The important thing is not to get discouraged when the inevitable dips occur.

Don’t let this scare you out of investing. Buffett advises staying the course through thick and thin as the market will always recover over time.

Cryptocurrencies will end badly.

These days, cryptocurrencies (or digital currencies) like Bitcoin are all the rage. However, the often-revolutionary billionaire is skeptical about the whole thing. Buffett believes that Bitcoin and the like are not value-producing assets, so they have no real, quantifiable value. It is important to note that Buffett has a strong track record in being right about his financial predictions, so there may be real weight behind his “Bitcoin is a bubble” forecast.

Indeed, there is much to learn about growing wealth from the third richest man in the world. But his most important advice is not about wealth at all, but rather, about how to live a life worth living: “Don’t forget what makes life enjoyable: being creative, and being with people you admire.” Truly, a billion-dollar advice from a man worth billions.

More inFinancial Adviser

-

Why Is the Price of Beef Rising in 2024?

Grocery shopping has become a challenging task with prices consistently on the rise. You may recall the unexpected surge in egg...

June 18, 2024 -

Did Tyler Perry Buy BET? The Story Behind the Partnership

Did Tyler Perry buy BET? While the media mogul’s attempt to acquire BET captured headlines in 2023, the story took an...

June 10, 2024 -

Fun and Exciting Things to Do When You’re Bored With Friends

Ever feel that awkward silence creeping in during a hangout with your friends? Been there, done that! We all know the...

June 4, 2024 -

What Is Equity in Business? Here’s What You Need to know

When embarking on the journey of growing a business, it’s crucial to grasp the concept of equity. So, what is equity...

June 2, 2024 -

Here Are the Best Saving Money Challenge to Boost Your Bank Balance

Ever feel like saving money is a daunting task? Imagine turning it into a fun game or a friendly competition! This...

May 25, 2024 -

Is Cardi B Dominican? The Star Sets the Record Straight on Her Identity

In the vibrant world of social media, where every aspect of a celebrity’s life is scrutinized, Cardi B recently took a...

May 19, 2024 -

Why Is It Important to Reconcile Your Bank Statements? The Ultimate Guide

Why is it important to reconcile your bank statements? Many business owners view bank statement reconciliation as a tedious task. However,...

May 12, 2024 -

Unlock Free Trips By Paying Mortgage & Loans with Credit Cards

Making large payments wouldn’t have been easier if it weren’t for credit cards. The system ensures full safety and quick transfer....

May 2, 2024 -

Skimpflation: Is Luxury Losing Its Luster?

In the glamorous world of luxury, a quiet revolution is underway, and it goes by the name of ‘skimpflation.’ Imagine your...

April 26, 2024

You must be logged in to post a comment Login